CEO STORIES

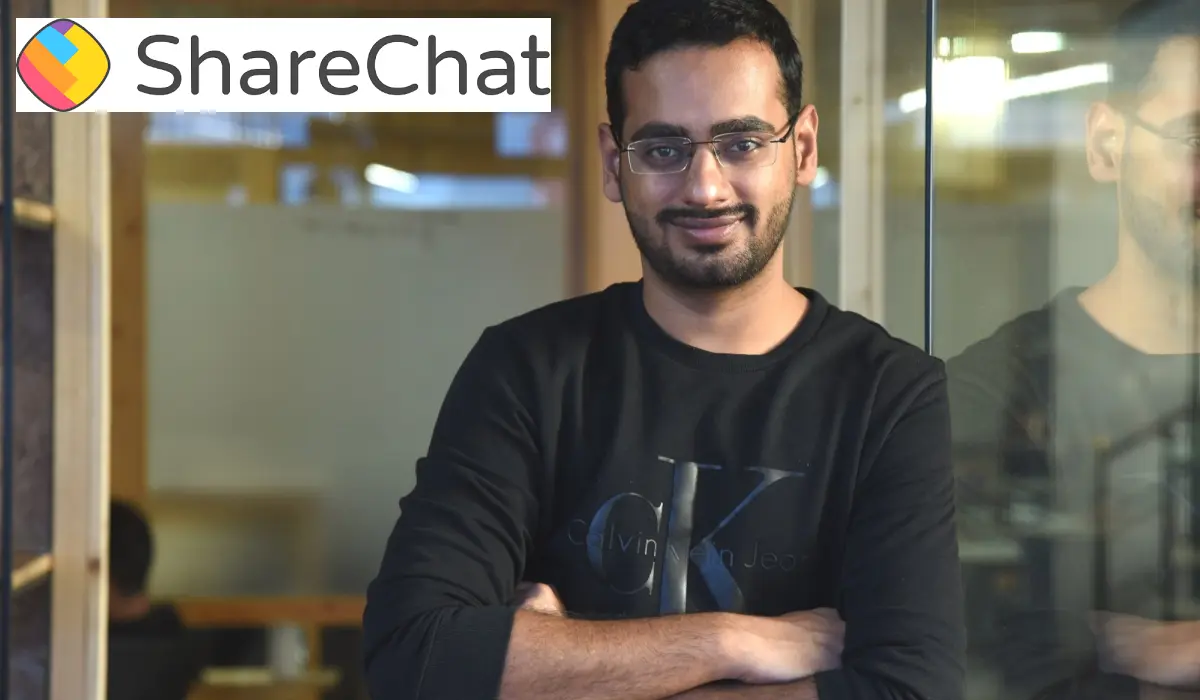

ShareChat Secures $48.8 Million in Debt Funding, Focuses on Profitability Path

SUMMARY

⏺ ShareChat raised $48.8 million via debt financing from existing investors, including Temasek and Lightspeed. This comes after a period of cost-cutting measures like employee layoffs and exiting non-core businesses.

⏺ The social media platform's revenue grew 62% year-on-year, reaching INR 540.21 crore in FY23. However, net losses also increased by 38%, reaching INR 4,064.3 crore in the same period.

⏺ Despite the financial challenges, ShareChat's focus on cost-cutting and continued support from investors positions them for navigating the competitive Indian social media landscape.

Bengaluru, India: Social media platform ShareChat has secured $48.8 million in fresh capital through convertible debentures issued to existing investors. This debt financing round comes amidst the company's ongoing efforts to achieve profitability.

Existing Investors Back ShareChat

The funding was provided by a consortium of existing investors, including Temasek, Lightspeed, HarbourVest, Moore Strategic, Alkeon Capital, and Tencent. This demonstrates continued support from key players in ShareChat's growth journey. Notably, this round comes nearly two years after ShareChat's previous equity funding of $255 million from prominent investors like Google and Temasek.

Cost-Cutting Measures Yield Results

ShareChat has undertaken significant cost-cutting initiatives over the past year. These efforts included streamlining operations, reducing employee headcount by approximately 800 across three separate layoffs, and exiting non-core businesses like the fantasy sports platform Jeet11 and live commerce ventures. These measures have demonstrably reduced the company's burn rate – the monthly cash outflow – to below $5 million. Additionally, the cost-cutting has contributed to a decrease in overall losses.

Financial Performance: Mixed Bag

While ShareChat's revenue has seen positive growth, its net loss has also increased. The company's net loss grew 38% year-on-year to INR 4,064.3 crore in FY23 compared to INR 2,941.5 crore in FY22. However, revenue witnessed a significant rise of 62%, reaching INR 540.21 crore in FY23, up from INR 332.69 crore in the previous year.

Leadership Changes and Future Outlook

ShareChat also witnessed leadership changes with the departure of co-founders Bhanu Pratap Singh and Farid Ahsan. They have since launched a new venture – a robotics startup named General Autonomy.

Despite the challenges, ShareChat's focus on cost-cutting and its ability to secure fresh funding from existing investors are positive signs. The company's overall funding to date surpasses $1 billion, with prominent players like Google, Twitter (now X), Tiger Global, and Tencent in its investor pool. With a renewed focus on profitability and a loyal investor base, ShareChat appears well-positioned to navigate the competitive social media landscape in India.

Latest News

STARTUP-STORIES